CDA Schools Present FY24 Proposed Budget

- Erin B.

- Jun 13, 2023

- 3 min read

The hot topic of the June 12th Coeur d’Alene School Board meeting was the annual budget hearing for FY24. The board will have a special meeting on June 26th to adopt the budget based on what was presented at the hearing on the 12th.

Below are the key takeaways but the full presentation can be downloaded here. Download full budget here.

Revenues

General

87% of the budget is staffing.

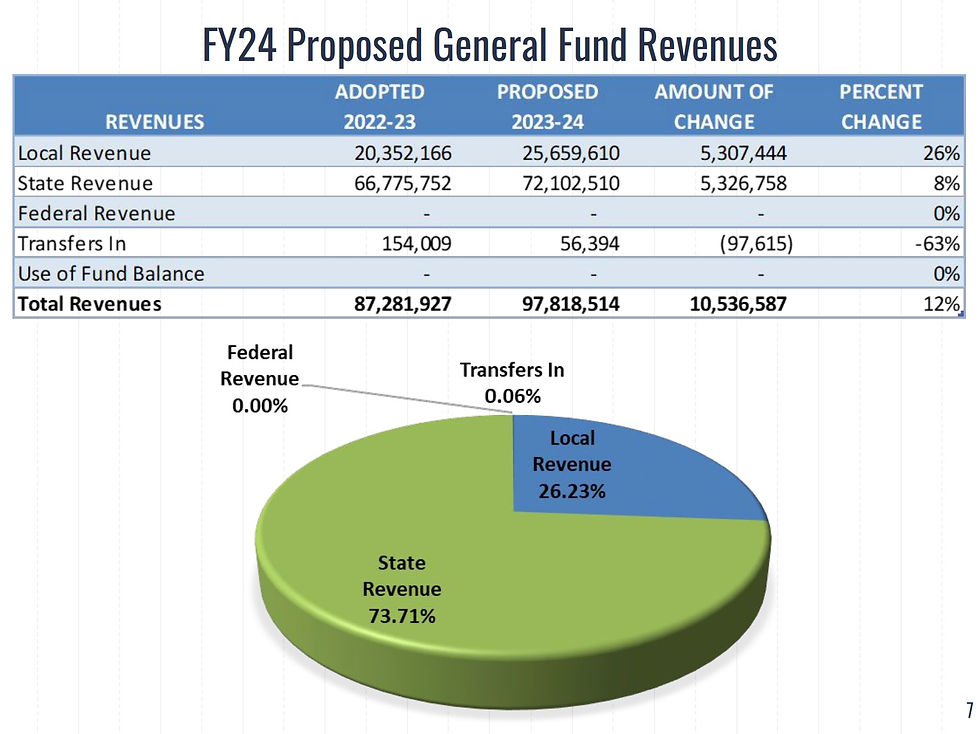

FY24 revenue is $10.5 million higher than last year, with half the new revenue coming from higher local taxes and half coming from the state.

State Revenue

The state is giving CDA School District $5.3 million in NEW funding.

State is going BACK to Average Daily Attendance for funding; during Covid they were using enrollment to calculate funding (since no one was actually ‘attending’ class). In a previous meeting, the finance director stated that because the state will be going back to ADA, the district estimated that they will be getting LESS support units (employees) funded but MORE money than they have in the past, equaling more money overall even though less “support units” are being funded.

The state has added money to the base salary on the salary matrix. Unfortunately, the CDA School District pays more than what the state recommends so the overall sentiment is a “not good enough” attitude towards the state funding. The state average salary is $57k but CDA School District average salary is $63k. The state pays:

Teachers - $6,359 MORE

Classified (Hourly) - $13,961 MORE

Admin – 4% MORE

Plus insurance/healthcare

Because school district employs more people than what the state allows, district uses levy tax dollars to pay for the extra employees.

State always pays a discretionary amount for the district to use at their own discretion. A percentage goes towards healthcare and a percentage goes toward whatever the district chooses. This year was a $1.2 million INCREASE.

Expenditures

General

Working budget: rolling budget that includes all salary changes and position changes throughout the year after the proposed budget was approved last year.

There is an $8.8 million increase between the FY23 working budget and FY24 proposed budget.

Reason for budget increase:

Fundraising isn’t good enough for sports equipment, $50k is being allocated to each high school and $15k for the middle schools combined.

Salary increases

Health insurance increases

Property insurance increases

New athletic equipment line item

Building budget increases for inflation

All are ongoing line items except for the $115k equipment line item, and they’re hoping to get more money to keep the equipment ongoing.

Payroll Budget

They are removing 24 teaching positions because they were too heavy on the teacher to student ratio, saving over $1.7 million. AKA “Right-sizing” positions

General Fund Balance

Contingency reserve must be at least 5% of general fund revenues ($97,818,514).

Unappropriated balance is anything more than contingency reserve.

Ending fund balance currently covers about 1 month of operating expenses.

Government Finance Officers Association (GFOA) recommends 60 days of operating expenses.

The general fund balance is currently at the HIGHEST level in at least the last 15 years.

One note: Child Nutrition will be operating at a deficit because government is going back to pre-C0vid funding formulas, so the district won’t be receiving as much money from the government, coupled with higher food costs and higher salaries.

Goals and Stakeholder Concerns

Inflation (yes but normal people typically cut back, not ask taxpayers to spend more)

Smarter School Spending Program

Last Thoughts By Finance

Forensic audit – doesn’t need to happen because there’s no fraud

Community just doesn’t understand the budget and the Smarter School Spending Program will “show them what we’re doing with our dollars.”

I saw a post that showed some expenses incurred by 271. They included nearly a million in education expenses for teachers including hotels air fare and meals. Also about a quarter million for DEI training. Another couple hundred thousand for pizza for the staff. And a couple thousand a month subsidy for the superintendents mortgage costs. Is this true? Maybe some forensic accounting could reveal wasteful spending? Maybe no one's committing fraud but MAYBE there's some places to cut back like the rest of us have to do. We are entitled to know where they money ALL goes. Google says 271 has 10107 students that attend school approx 175 days a year