CDA Schools Board of Trustees Meeting 11/13/23 Update

- Erin B.

- Nov 14, 2023

- 3 min read

Below are the updates from the Coeur d'Alene School District Board of Trustees meeting held at 5pm on November 13, 2023. The updates are in bullet point format to easily give the highlights from each agenda item.

Financial Audit Presentation

The FY23 financial audit was presented by CDA Schools’ new CPA Hayden Ross. There were many interesting points that were presented and it is highly recommended that everyone read the 106-page audit report to understand the district’s financials.

Points of Interest:

During the 2022-23 fiscal year, there was a decrease of 54 students in the fall enrollment compared to the same reporting period in 2021-22. However, the enrollment was still down from the pre-COVID number of 2019-20 by 938 students.

There was a $3.2 million increase in state support revenues for the general fund due to a $6,382 increase in discretionary funding compared to the prior year.

The District's general fund ending balance decreased by $321,000 compared to the previous year. The decrease was due to various factors. Property tax reconciliation and adjustments to prior year property taxes resulted in a decrease of $280,000 in property tax revenue. Medicaid expenditures of $67,000 were transferred from the General Fund to balance the Medicaid fund to the amount deposited in the Medicaid match fund held by the State.

It is important to note that ESSER III was used for staff retention and to help cover the cost-of living increase that was approved by the board in June 2023. This increase was estimated to have a $1.2 million impact on the General Fund, which would have resulted in an operating deficit. The board approved the use of ESSER III dollars to cover the deficit and retain staff.

In FY23, the District received $19.8 million from its supplemental property tax levy. This sum accounted for 23% of the total General Fund revenues.

State support revenue increased by $4.3 million due to a $6,382 per support unit increase in discretionary funding for health insurance.

In 2022-23, the District received a bond interest stabilization payment of $127,355. This revenue helps reduce the burden on the local property taxpayer for bond interest.

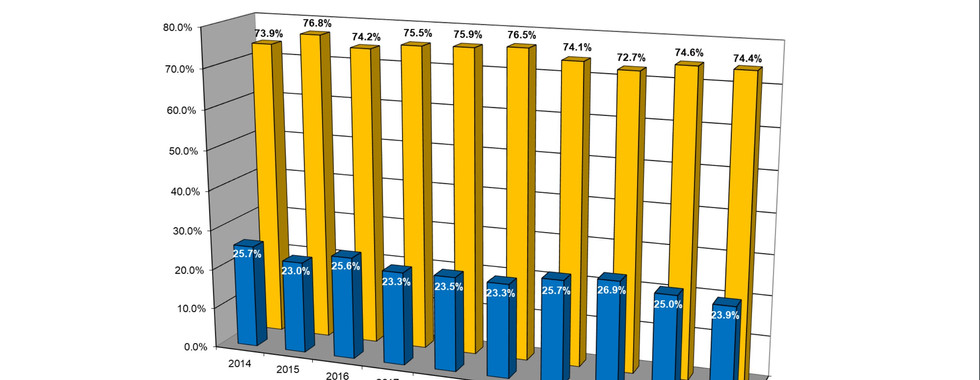

Accompanying Graph Charts to Emphasize Overall General Fund

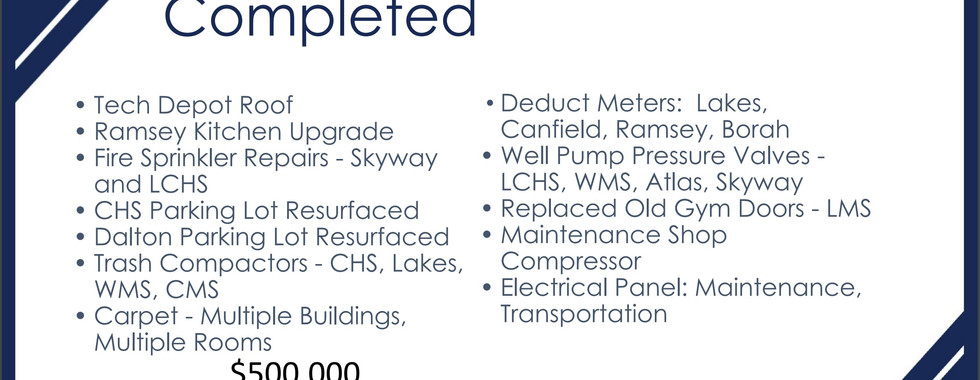

Deferred Maintenance & Major Project Update

Full presentation linked; completed and upcoming projects below.

Second Reading: Policy 3255 – Student Dress Code

After a 30-day public comment period, the student dress policy was updated according to some public comments and student approval. The board believes that the dress policy is better than what it was at the onslaught of this process, but as the adults in the room, they need to ensure that the policy represents a standard that prepares the students for the real world, and that any updated policy can and will be enforced properly.

The board is scheduling a workshop in December to further discuss the dress code policy and *hopefully* finalize the policy to be able to approve at the next regular meeting.

Current draft policy below:

Other Items

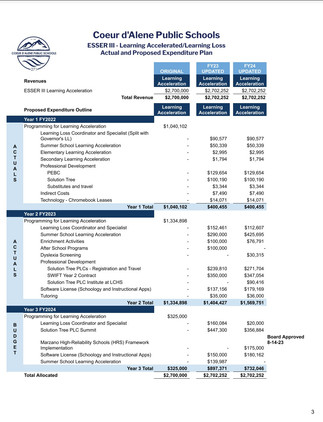

An ESSER update was included in the Board Information but was not discussed in the meeting. The ESSER III funds were updated with the FY23 Actuals and show the estimated budget for FY24.

With the rest of the ESSER funds and the FY24 proposed budgets, the district is still $1M over budget so they had to draw from other sources to ensure they could cover the expenses, including cancelling the Midtown Meeting Center expansion project until a later date.

Comments